Dividend Aristocrats: Top 10 Stocks for Long-Term Wealth Building

Investing in the stock market can feel like navigating a maze—especially when seeking consistent returns with minimal risk. Enter Dividend Aristocrats, a prestigious group of companies that have consistently increased their dividends for at least 25 consecutive years. These stocks are considered prime choices for income-focused investors and those looking for long-term financial security.

Investing in the stock market can feel like navigating a maze—especially when seeking consistent returns with minimal risk. Enter Dividend Aristocrats, a prestigious group of companies that have consistently increased their dividends for at least 25 consecutive years. These stocks are considered prime choices for income-focused investors and those looking for long-term financial security.

In this comprehensive guide, we’ll explore the top 10 Dividend Aristocrats, examining their history, performance, and potential for future growth. Along the way, we’ll share expert insights, actionable tips, and compelling case studies to help you make informed investment decisions.

What Are Dividend Aristocrats?

Dividend Aristocrats are companies in the S&P 500 that have a history of increasing dividends annually for at least 25 years. These businesses often belong to defensive sectors like consumer staples, healthcare, and industrials, offering stability even during economic downturns.

Why Invest in Dividend Aristocrats?

-

Consistent Income – These stocks provide reliable dividend payouts, making them ideal for passive income seekers.

-

Lower Volatility – Historically, Dividend Aristocrats are less volatile compared to the broader market.

-

Inflation Hedge – Rising dividends help protect purchasing power over time.

-

Long-Term Growth – Many of these companies exhibit strong fundamentals and steady capital appreciation.

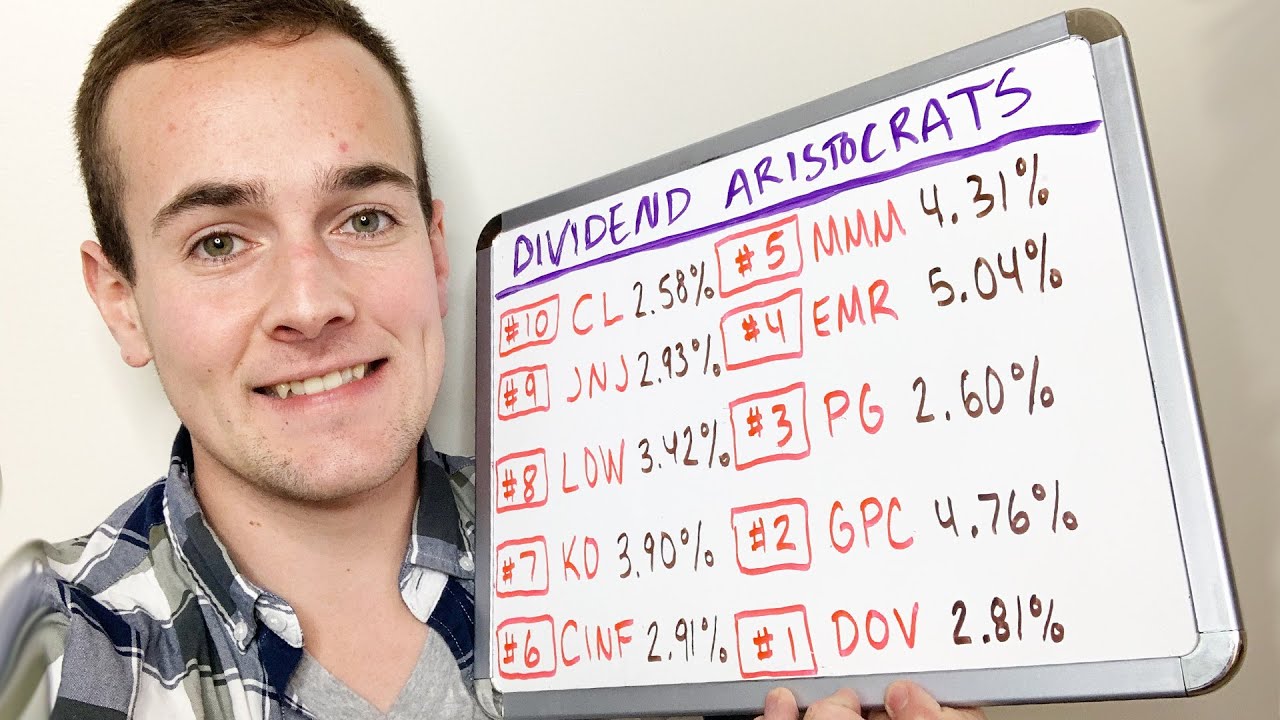

Top 10 Dividend Aristocrats to Watch in 2024

1. Procter & Gamble (PG)

Sector: Consumer Staples

Procter & Gamble has been a household name for over 180 years, offering trusted brands like Tide, Pampers, and Gillette. With a 67-year streak of dividend increases, PG remains a pillar of financial resilience.

2. Johnson & Johnson (JNJ)

Sector: Healthcare

As a leader in pharmaceuticals, medical devices, and consumer health, J&J has raised dividends for over 60 years. Its diversified revenue streams make it a rock-solid investment.

3. Coca-Cola (KO)

Sector: Consumer Staples

Few brands are as globally recognized as Coca-Cola. With a 61-year dividend growth streak, KO continues to reward investors while expanding into health-conscious beverage options.

4. McDonald’s (MCD)

Sector: Consumer Discretionary

McDonald’s isn’t just about burgers—it’s a real estate powerhouse. The company has consistently boosted dividends for 47 years, thanks to strong global sales and a resilient business model.

5. 3M Company (MMM)

Sector: Industrials

From adhesives to healthcare products, 3M is an innovation-driven giant. Despite recent headwinds, its dividend track record of 65 years keeps it on the Dividend Aristocrat list.

6. Walmart (WMT)

Sector: Consumer Staples

Walmart’s aggressive expansion into e-commerce and grocery delivery has strengthened its market position. With 50 years of consecutive dividend increases, it’s a must-watch for dividend investors.

7. Abbott Laboratories (ABT)

Sector: Healthcare

Abbott’s focus on diagnostics, nutrition, and pharmaceuticals has fueled its dividend growth for nearly 52 years, making it a strong contender in the healthcare sector.

8. Colgate-Palmolive (CL)

Sector: Consumer Staples

As a leading producer of oral and personal care products, Colgate-Palmolive boasts over 60 years of dividend growth, backed by brand loyalty and global expansion.

9. ExxonMobil (XOM)

Sector: Energy

Despite fluctuations in oil prices, ExxonMobil has maintained its dividend growth streak for 41 years, making it a dependable choice in the energy sector.

10. PepsiCo (PEP)

Sector: Consumer Staples

PepsiCo’s diversified portfolio—ranging from soft drinks to snacks—ensures steady revenue. With a 50-year dividend growth record, it remains an investor favorite.

Key Takeaways from Dividend Aristocrats

-

Resilience in Bear Markets – These stocks tend to outperform during economic downturns.

-

Dividend Growth Outpaces Inflation – Continuous dividend hikes provide protection against rising living costs.

-

Long-Term Wealth Accumulation – Reinvesting dividends compounds wealth over time.

Frequently Asked Questions (FAQs)

1. How are Dividend Aristocrats different from high-yield stocks?

Dividend Aristocrats prioritize consistent dividend growth, while high-yield stocks may offer large dividends without stability.

2. Are Dividend Aristocrats good for retirees?

Yes! Their reliable income stream and low volatility make them ideal for retirement portfolios.

3. Do Dividend Aristocrats always outperform the market?

While not guaranteed, they have historically outperformed during recessions and bear markets.

4. Can new companies join the Dividend Aristocrats list?

Yes, if they meet the 25-year dividend growth requirement and are part of the S&P 500.

5. Should I reinvest dividends or take cash payouts?

Reinvesting dividends maximizes compound growth, while cash payouts offer immediate income. The choice depends on your financial goals.

Final Thoughts: Is Investing in Dividend Aristocrats Worth It?

Dividend Aristocrats are more than just stocks; they represent financial security, long-term growth, and stability. Whether you’re a beginner investor or a seasoned pro, these companies offer a time-tested approach to building wealth. By carefully selecting the right Aristocrats, diversifying your portfolio, and reinvesting dividends, you can create a robust financial future.

Are you ready to start investing in Dividend Aristocrats? Consider consulting a financial advisor to tailor an investment strategy that suits your goals.